Wall Road’s largest banks are warning that present assumptions round much-needed inexperienced finance will now not maintain if the US goes forward with stricter capital necessities.

Article content material

(Bloomberg) — Wall Road’s largest banks are warning that present assumptions round much-needed inexperienced finance will now not maintain if the US goes forward with stricter capital necessities.

The Basel 3 Endgame, because the deliberate guidelines have been dubbed, marks the ultimate implementation stage within the US of laws created after the monetary disaster of 2008. Banks might want to put aside extra capital, which is able to make it costlier for them to offer finance. Proposed in July by a bunch of US authorities that features the Federal Reserve, the foundations will “essentially alter” how banks on the planet’s largest financial system strategy threat, EY says.

Commercial 2

Article content material

Article content material

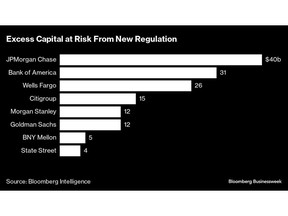

JPMorgan Chase & Co. estimates the plan would depart it going through a 25% capital bump, which might “for positive” have an effect on its potential to allocate funds to inexperienced initiatives, in line with Chief Working Officer Daniel Pinto. And Goldman Sachs Group Inc. Chief Government Officer David Solomon says the financial institution’s capital necessities would “quadruple” for sure clear power initiatives.

The upshot is that Wall Road should rethink present local weather financing buildings, mentioned John Greenwood, co-head of Americas structured finance at Goldman.

“Given all of the issues that business banks are going through within the context of Basel,” the monetary buildings of present local weather offers are beginning to look a bit “antiquated,” Greenwood mentioned in an interview. That’s significantly true of a climate-funding mannequin often known as blended finance, whereby offers are de-risked by the general public sector with the intention to lure personal capital. These enticements at the moment are going to wish to take banks’ additional capital prices under consideration, he mentioned.

The eight largest US banks at the moment have capital necessities starting from $9 to $13 for each $100 in risk-weighted belongings. Below the brand new guidelines, they would want so as to add roughly $2 extra.

Article content material

Commercial 3

Article content material

“With the incremental capital wanted to fund the inexperienced transition, banks will look to work alongside different corners of personal finance that maybe aren’t topic to the identical laws,” Greenwood mentioned. “What we’re seeing now by way of new funding in power and infrastructure can be a want for the way can we crowd in and help institutional buyers, given the constraints that business banks have underneath Basel.”

It’s the newest actuality test from a finance trade that spent a lot of the COP28 local weather summit in Dubai reminding the world that it’ll solely take part within the inexperienced transition if the returns are interesting. “You need to make a revenue,” hedge fund billionaire Ray Dalio mentioned at COP28. And personal capital can’t get entangled if there isn’t “a business return,” Shriti Vadera, chair of Prudential Plc, mentioned in Dubai.

Learn Extra: Hedge Fund Titan Ray Dalio Will get Income Again on Inexperienced Agenda

In keeping with Jeff Berman, New York-based companion and US monetary providers regulatory group lead at regulation agency Clifford Likelihood, Wall Road is now “ a trade-off between the security and soundness of the banking system, and the targets of local weather coverage.”

Commercial 4

Article content material

The clear message from bankers is that reaching a business return will likely be more durable as soon as capital necessities go up. Which means plenty of finance is ready to maneuver away from banks and into the murkier realm of shadow banking, the place threat ranges aren’t monitored as carefully, in line with the trade.

“Policymakers must be involved with a ensuing shift away from regulated entities to less-regulated and fewer clear markets and establishments,” JPMorgan CEO Jamie Dimon mentioned in a Senate listening to earlier this month.

Goldman’s Solomon says financing will occur in corners of the market over which “regulators have far much less visibility,” that means dangers may construct up and “in the end result in monetary shocks.”

Learn Extra: Why Larger ‘Capital Cushions’ Have Banks On Edge: QuickTake

Multilateral growth banks agree that inexperienced finance fashions might should be adjusted due to the regulatory atmosphere.

Odile Renaud-Basso, president of the European Financial institution for Reconstruction and Improvement, mentioned Basel 3 presents “ excuse” for international banks to again away from local weather finance. “However there are perhaps some components that we have to look into as a result of rising market threat is seen as variable and the strategy isn’t very conducive for placement,” she mentioned.

Commercial 5

Article content material

Wall Road has spent the previous months warning of the impression of stricter capital guidelines on all the pieces from mortgages to small enterprise loans. The United Nations local weather summit was simply the newest venue for bankers to unfold their message.

In a analysis paper distributed at COP28, Citigroup Inc. mentioned regulators ought to “think about the implications of buildings resembling Basel 3, which may inadvertently hinder funding into infrastructure initiatives and markets that might make a significant distinction to local weather and growth finance.”

The Basel 3 guidelines make financing inexperienced infrastructure troublesome for banks, Jay Collins, Citigroup’s vice chairman of company and funding banking, mentioned in an interview. That’s as a result of it’s sometimes funded on the challenge degree and tends to be long-term and illiquid, which is the sort of lending the Basel guidelines deter.

“So long as there’s a lot coverage noise and regulatory fog, the multifold enhance in local weather funding gained’t occur,” Collins mentioned.

Learn Extra: Citi Explores New Deal Constructions in Battered Offsets Market

Commercial 6

Article content material

Hendrik du Toit, CEO of South Africa-based asset supervisor Ninety One, mentioned his concern is that American and European financiers are already too risk-averse, and any extra hindrance will find yourself hitting the rising markets most in want of local weather finance.

“Western capital is simply too conservative,” he mentioned throughout a panel dialogue in Dubai. “It’s shopping for greenback money, US greenback bonds, and it’s comfy sitting at residence. We have now to vary that. There are returns available” in rising markets

The dangers related to local weather finance have been underscored this yr, as larger rates of interest and supply-chain bottlenecks dragged down key inexperienced sectors. The S&P International Clear Vitality Index is down nearly 30% in 2023, in contrast with a 23% acquire for the S&P 500.

Citigroup’s Collins mentioned the numbers communicate for themselves. The Basel guidelines imply “international banks will proceed to wrestle to satisfy regulatory capital return hurdles on inexperienced infrastructure,” he mentioned.

—With help from Alastair Marsh.

Article content material

Source link